The Annual Filing Season Program (AFSP)

Paid preparers fill out more than half of the individual tax returns that are filed each year. With the aim of improving the accuracy of the majority of tax returns filed in the United States, the IRS introduced the "Annual Filing Season Program" (AFSP) in 2014. The AFSP is a voluntary program designed to reward paid preparers with special benefits if they choose to expand their knowledge of federal tax matters through continuing education (CE).

Those who choose to participate in the program can meet the requirements by obtaining specified hours of continuing education and meeting other prerequisites before the upcoming filing season.

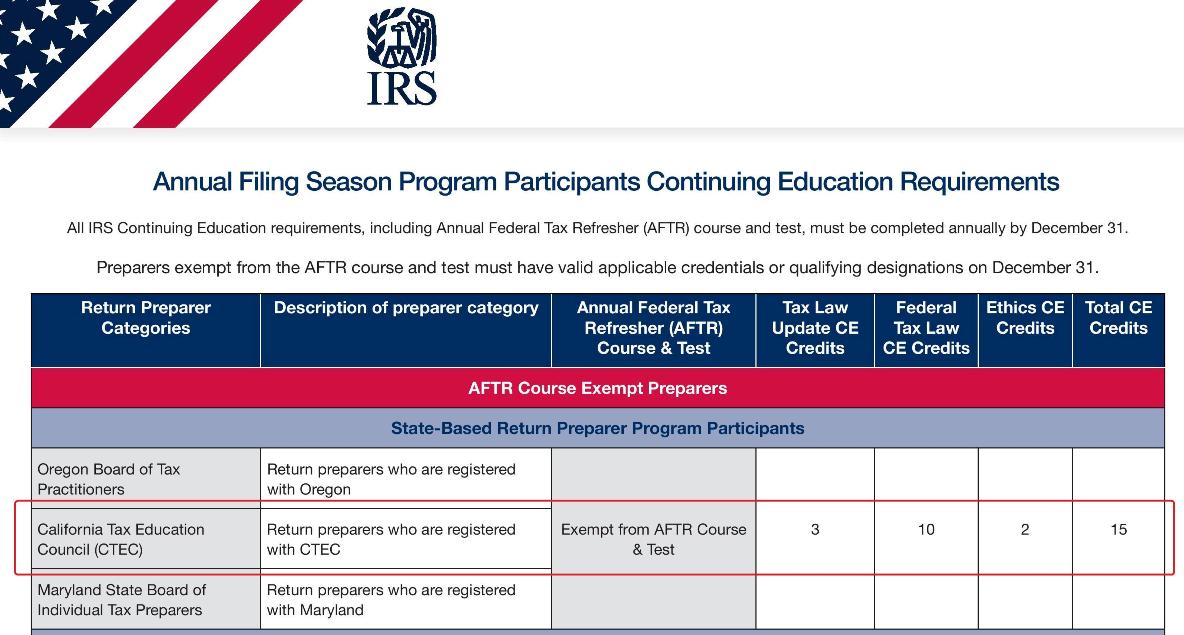

CTEC and the IRS Have Different Educational Requirements

Many of us will think that the IRS requires the same number of CE credit hours as CTEC. It turns out that the IRS does not have a state tax law requirement. Unlike CTEC (a state agency), the IRS (a federal agency) does not require you to take a 5-hour course on California tax laws. To qualify for AFSP benefits, CTEC-registered tax professionals (CRTPs) need to complete 10 hours of federal law, 3 hours of federal update, and 2 hours of federal ethics -- the sum of which is 15 hours.

AFTR Course

The majority of tax preparers in the United States do not possess a professional credential and need 18 CE hours to qualify for AFSP benefits. In addition to 10 hours of federal tax laws and 2 hours of ethics, non-credentialed tax preparers must complete a 6-hour Annual Federal Tax Refresher (AFTR) course.

CRTPs are Exempt from the AFTR Course

Tax professionals with a CTEC credential (CRTPs) can qualify for AFSP benefits without taking the 6-hour AFTR course. Please take a look at the IRS chart below [Source: https://www.irs.gov/pub/irs-pdf/p5646.pdf]:

For more information on the reduced AFSP requirements for CRTPs, please click on the link below:

The CE program you complete with us will award 15 credit hours toward the AFSP, which is the appropriate amount of CE for CRTPs. If the IRS asks you to complete three more CE hours (to reach 18 total), then it is very likely that your CTEC credential is not being recognized by the PTIN system.

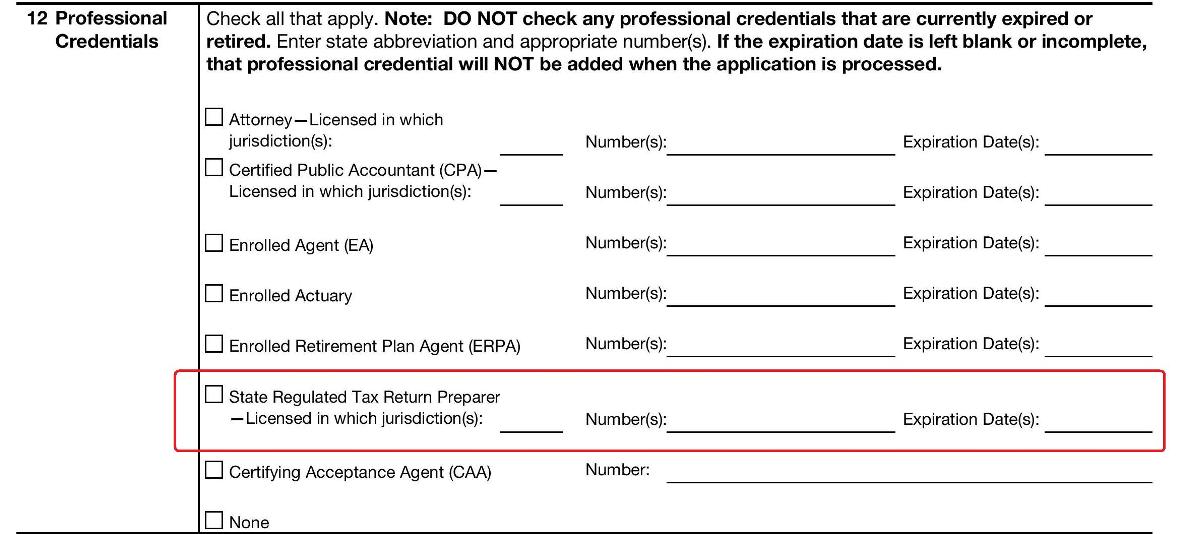

How Does the IRS Know That an AFSP Participant is a CRTP?

There is a section on the PTIN application where the IRS will ask for “Professional Credentials.” CRTPs need to check the box next to “State Regulated Tax Preparer.” Then, in the following columns, CRTPs should enter “California,” CTEC account/ID number, which will expire on October 31st of the next year.

The IRS and CTEC have jointly devised a

method of authenticating a PTIN-holder's CTEC registration/credential

status.

When the “Professional Credentials” section of your PTIN account is not

filled out correctly (or your CTEC information could not be

authenticated), the IRS will assume you're a NON-CREDENTIALED tax

preparer and they will ask you to complete 18 hours instead of 15 hours

for the AFSP.

If you believe the “Professional Credentials” section of your PTIN account is filled out correctly, yet the IRS is still asking you to complete the AFTR course and 18 hours for the AFSP, please call the PTIN Hotline (877-613-7846) for assistance.

Non-Educational Prerequisite 1: PTIN Renewal

Although the AFSP is a voluntary program, the IRS still requires all tax return preparers to have a Preparer Tax Identification Number (PTIN). AFSP participants are expected to renew their PTIN between October 15 and December 31. The participant will not qualify for any AFSP benefit unless they complete continuing education and renew their PTIN by December 31.

Non-Educational Prerequisite 2: Circular 230 Adherence

Once a CRTP has completed their continuing education requirements and renewed their PTIN for the upcoming year, they will receive an email from the IRS. The CRTP will be asked to log in to their PTIN account. On the Main Menu, they should select “AFSP Record of Completion — Circular 230 Consent” then follow the prompts and agree to abide by the duties and restrictions relating to practice before the IRS in Subpart B of Circular 230.

Benefit 1: Record of Completion

About four weeks after consenting to Circular 230 through their online PTIN account, the CRTP will receive an AFSP Record of Completion from the IRS which can be displayed and used to stand out from the competition. This certificate will be available in the PTIN holder’s online IRS account for printing. The Record of Completion will show clients and potential clients that the recipient is a well-educated tax preparer who is dedicated to their chosen profession.

Benefit 2: Inclusion in IRS Directory

Preparers who receive the Record of Completion will also have the benefit of being included in the IRS directory of tax professionals with select qualifications. This online database (https://irs.treasury.gov/rpo/rpo.jsf) provides a way for the public to search for qualified tax professionals in their area. The directory is a searchable, sortable listing that taxpayers can use to find a return preparer who is up-to-date on current tax laws and who has met certain educational requirements. The directory will include the name, city, state, and zip code of AFSP participants who have obtained a Record of Completion.

Benefit 3: Representation Rights

PTIN holders without an AFSP

Record of Completion or a professional credential can prepare tax

returns, but they will not be allowed to represent clients before the

IRS.

AFSP participants, on the other hand, will earn limited representation

rights. They can represent their clients before customer service

representatives and similar IRS employees. AFSP participants can even

represent clients during initial audits “before revenue agents,” but

they may not represent their clients before appeals officers, revenue

officers, or IRS counsel. To gain these limited representation rights,

CRTPs must participate in the Annual Filing Season Program both in the

year when the client's return was prepared and the year when the client

is represented.