Do you offer the IRS AFTR course?

To qualify for AFSP benefits,

non-credentialed tax preparers must obtain 18 hours of continuing

education. In addition to 10 hours of federal tax laws and 2 hours of

ethics, non-credentialed tax preparers must complete a 6-hour Annual

Federal Tax Refresher (AFTR) course.

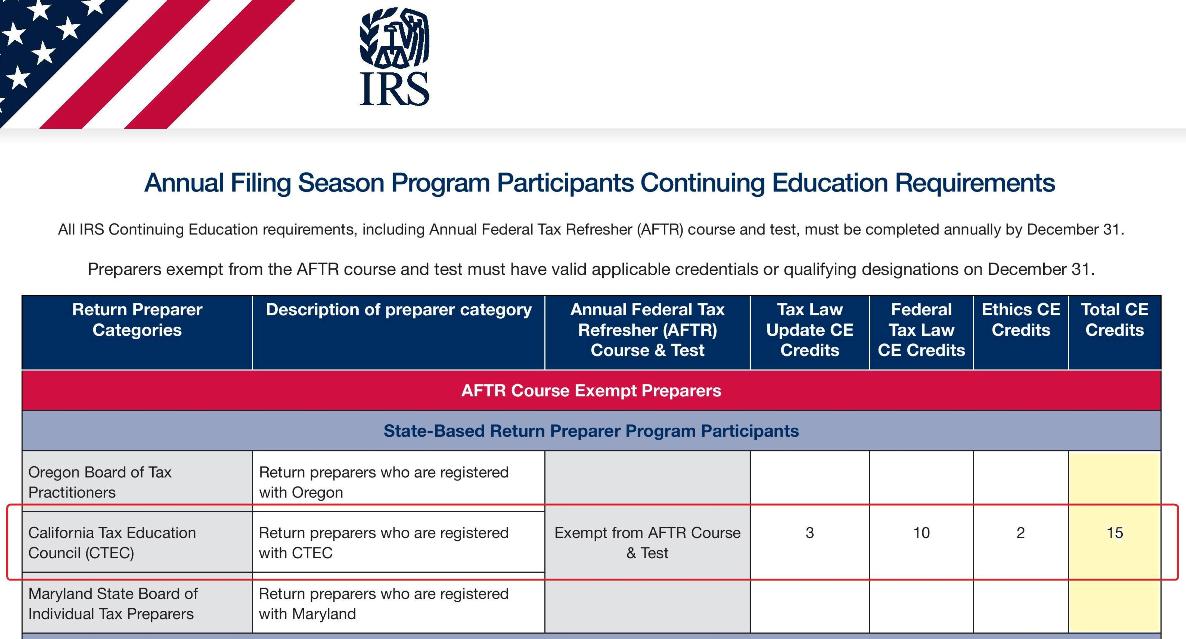

The California Tax School primarily serves CTEC-registered tax

professionals (CRTPs), who are exempt from the AFTR course.

CRTPs can qualify for AFSP benefits

without taking the 6-hour AFTR course. The IRS has specifically exempted

CRTPs from the 6-hour AFTR course. However, CRTPs must still complete 15

hours of continuing education (10 hours of federal tax laws, 2 hours of

ethics, and 3 hours of update) by December 31 to qualify for AFSP

benefits.

The California Tax School does not offer the AFTR course because it is

not intended for CTEC-registered tax professionals.

Instead, we offer a 20-hour CTEC+IRS program which includes 10 hours of

federal tax laws, 2 hours of ethics, and 3 hours of update.

If you are a tax preparer who lives and works outside California, please click on the link below to view a list of IRS-approved CE providers offering the AFTR course:

https://www.ceprovider.us/public/default/listing

Back to Frequently Asked Questions